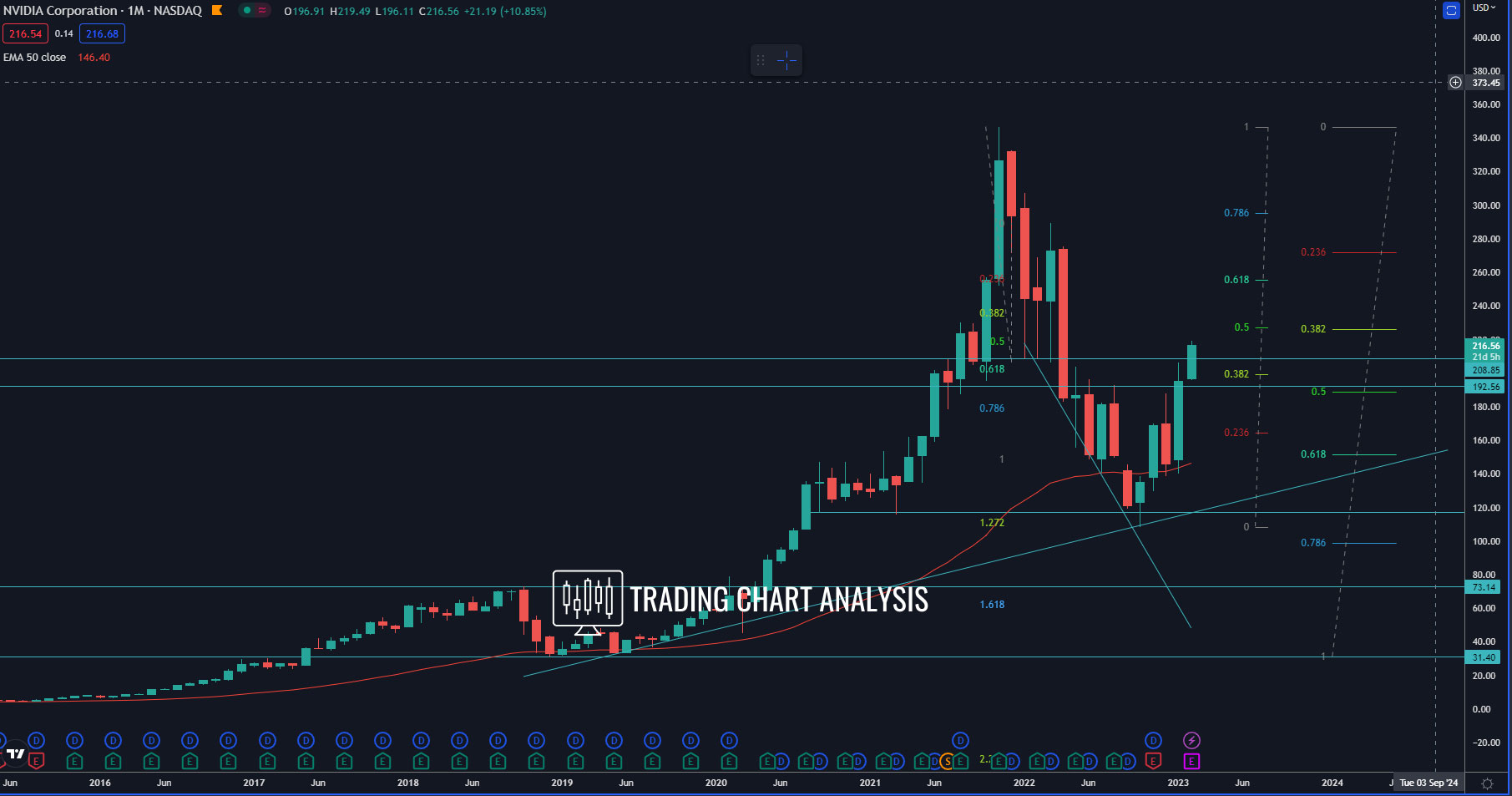

Explore open, high, low, and close data for better insights. · nvidia presents a fascinating disconnect between bearish technical signals and robust fundamental performance. · this classic bearish formation suggests a potential reversal is looming. Nvda has formed the infamous head and shoulders pattern — a structure that typically signals potential downside and is considered bearish if it confirms. Should the neckline at $137 break, nvidia could be vulnerable to a significant decline, with a target of $100 in sight. · nvidia is a huge battleground stock – – some analysts predict its price will languish or crash, while others see it continuing its dramatic rise. The daily chart shows clear technical deterioration with a potentially bearish head and shoulders pattern forming, suggesting short-term downside risk to $100 if current support fails. · a visible head and shoulders pattern on the daily chart is raising caution among market analysts, as this classical chart formation is often interpreted as a potential bearish signal. · and right now, the chart is telling a very different story. Interactive chart for nvidia corporation (nvda), analyze all the data with a huge range of indicators. Analyze the nvidia candlestick chart and patterns to track price trends, movements, and key levels. It has become the world’s most valuable company by market capitalization.