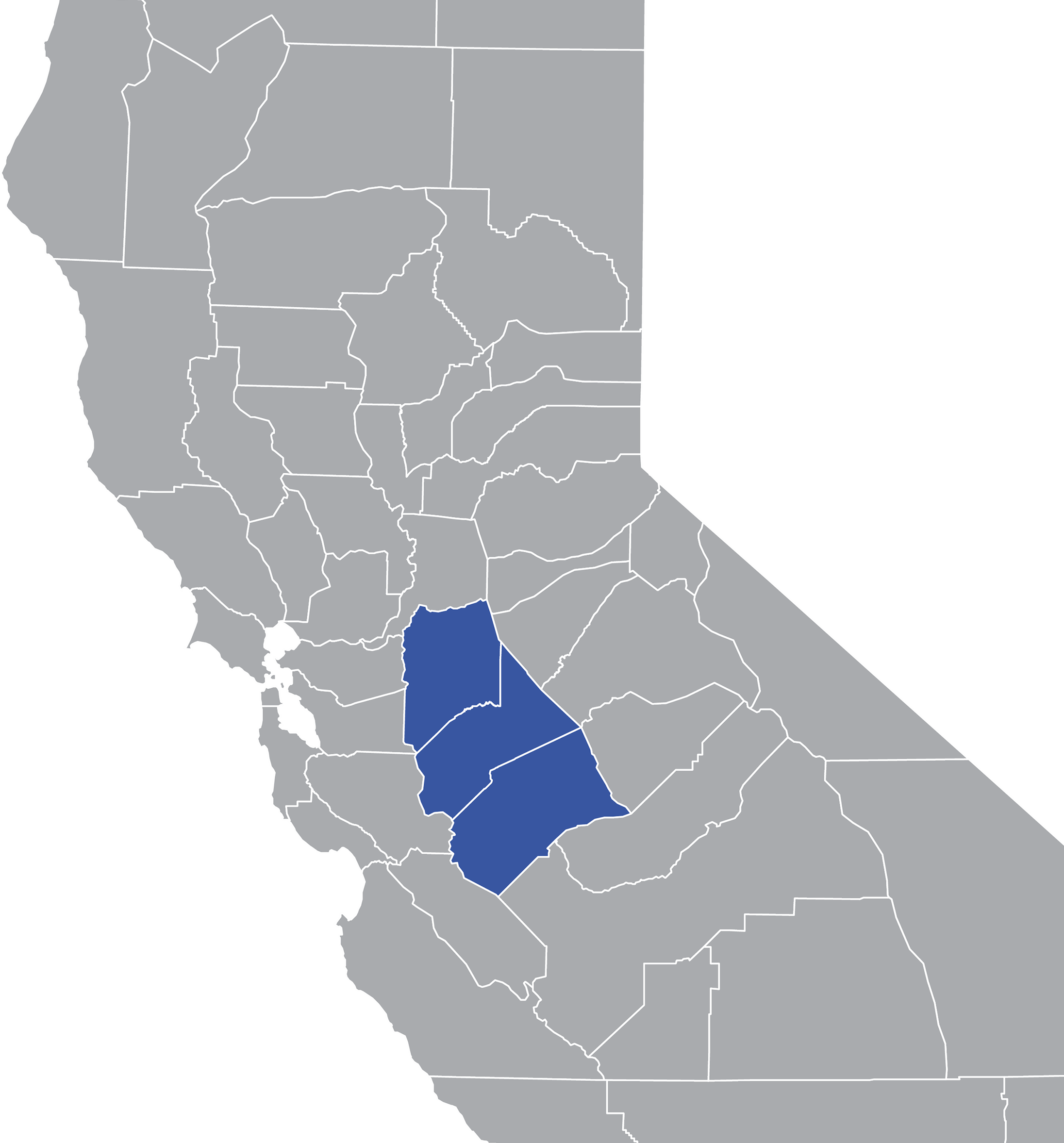

Webproperty & tax information. Webwelcome to the transfer/excise tax calculator. This tool can calculate the transfer/excise taxes for a sale or reverse the calculation to estimate the sales price. Webyou may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting in a property tax savings of approximately $70 annually if you own and occupy. Weba good rule of thumb for california homebuyers who are trying to estimate what their property taxes will be is to multiply their home's purchase price by 1. 25%. Webthe county assessor has a constitutional responsibility to determine the value of and assess all taxable property in the county. That assessment is used to compute the. Payment plans may not be. Webclick on a state to find the most current information about property tax rates, exemptions, collection dates and assessments. How much you pay in property taxes each year can. Webto use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). For comparison, the median home value in san. Websearching for san joaquin county, ca property tax information? Instantly look up property tax data for any san joaquin county, ca home by typing the exact address in.